Our core expertise

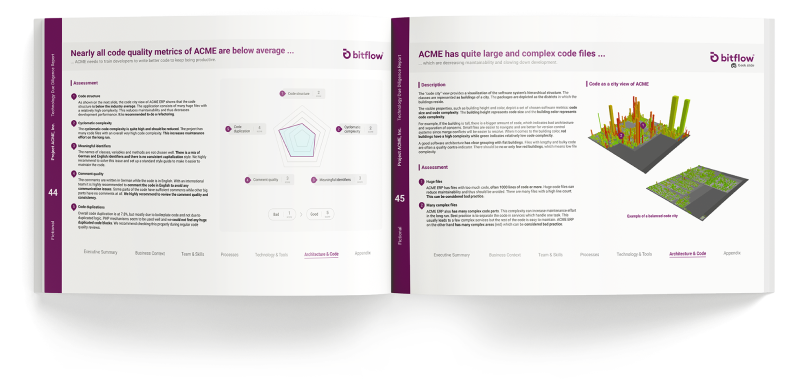

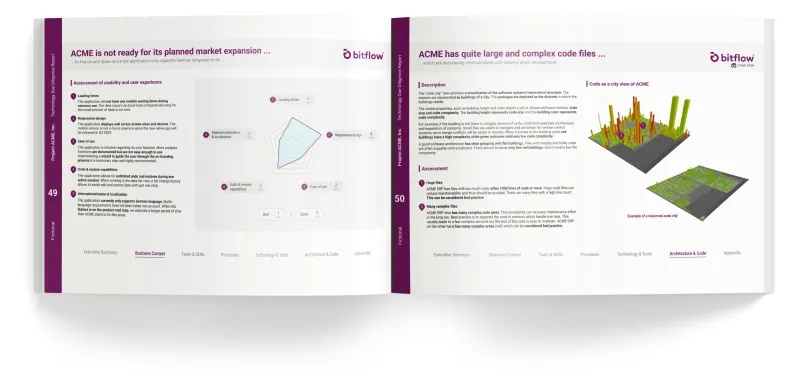

System Architecture

Examining scalable architectures, DevOps, as well as system and database design.

Static Code-Analysis

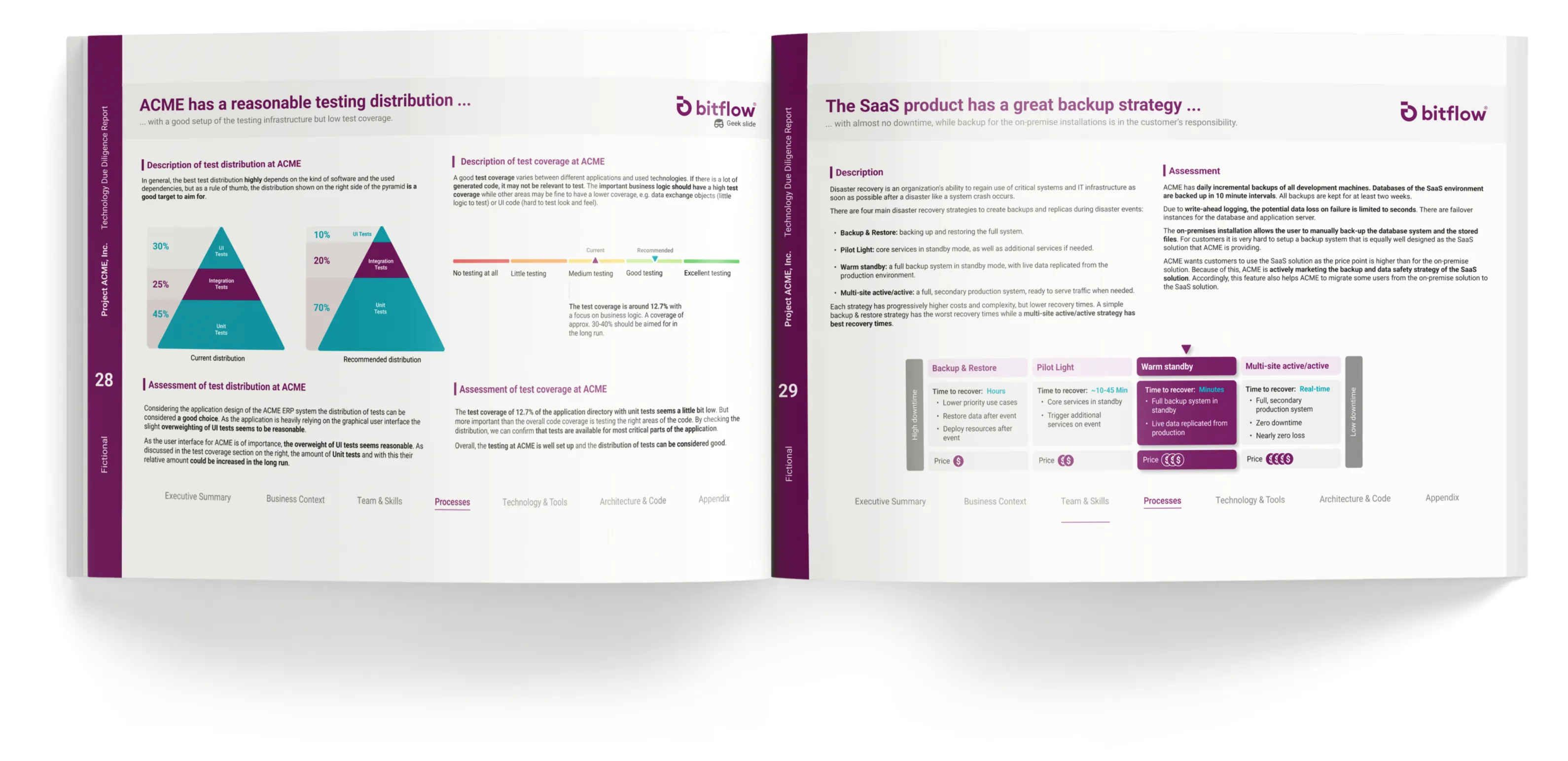

Code quality, test coverage and analysis of technical debts scalable to millions of lines of code.

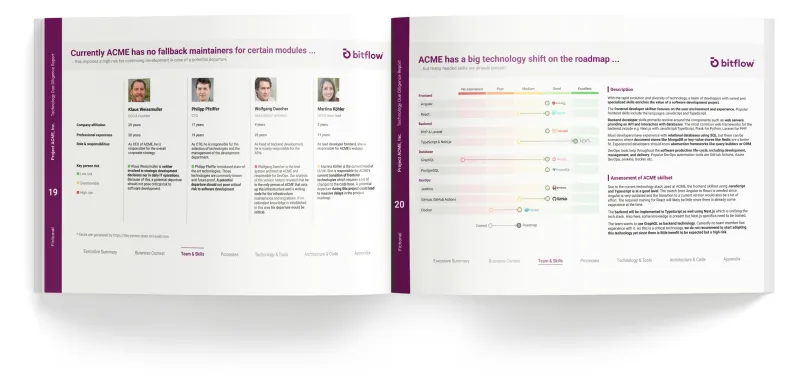

Team Performance

Analyze commits to derive statistics and risk of key personnel.

Infrastructure Cost Analysis

Analyze the cost structure of using IaaS providers and develop an exit strategy.

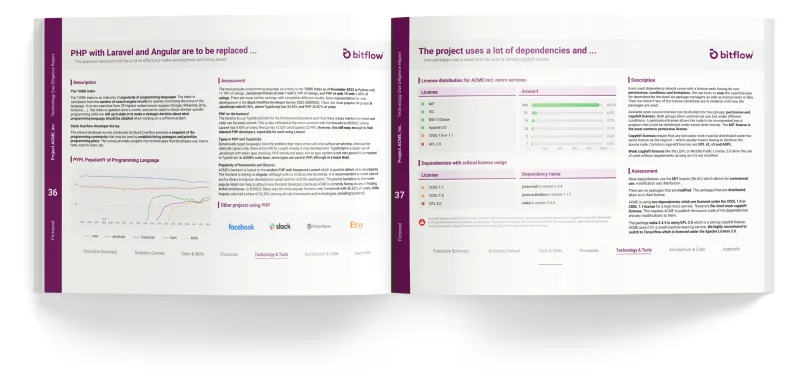

License Verification

Checking licenses of all external dependencies, e.g. to detect copy-left licenses.

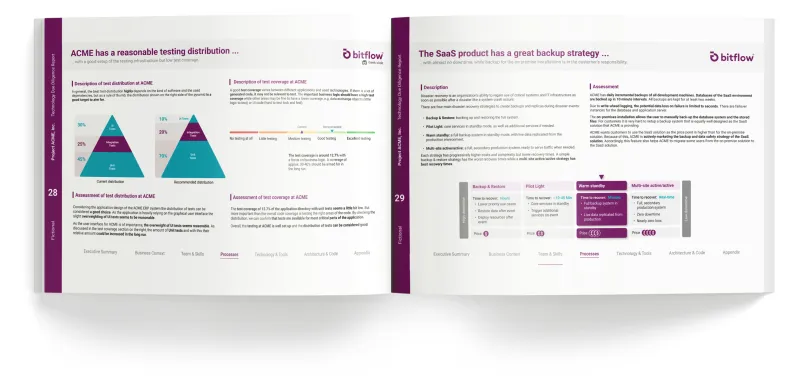

Safety & Reliability

Performing penetration testing (black- & white-box), as well as analyzing backup strategies.